Overview

WealthKarma is a financial planning platform that empowers GCC expats to manage savings, investments, and retirement with ease and confidence.

01

01

Context

Context

Background

Background

People don’t manage money in isolation — their financial behaviors are shaped by their personal context.

People don’t manage money in isolation — their financial behaviors are shaped by their personal context.

A fresh graduate

A fresh graduate

Starting their first job might focus on tracking expenses and building savings,

Starting their first job might focus on tracking expenses and building savings,

Young family

Young family

Prioritizes insurance and emergency funds for safety

Prioritizes insurance and emergency funds for safety

Nearing retirement

Nearing retirement

Long-term stability and predictable growth

Long-term stability and predictable growth

These shifting priorities depend on factors like life stage, income stability, financial goals, and risk tolerance.

However, most financial tools today still offer generic and fragmented experiences. They mainly focus on basic expense tracking or manual goal setting without reflecting the user’s overall financial health. Recommendations often feel one-size-fits-all, leaving users uncertain about where they stand and what to do next. As a result, financial planning becomes reactive rather than guided, and users end up juggling multiple disconnected apps to manage saving, insurance, and retirement.

These shifting priorities depend on factors like life stage, income stability, financial goals, and risk tolerance.

However, most financial tools today still offer generic and fragmented experiences. They mainly focus on basic expense tracking or manual goal setting without reflecting the user’s overall financial health. Recommendations often feel one-size-fits-all, leaving users uncertain about where they stand and what to do next. As a result, financial planning becomes reactive rather than guided, and users end up juggling multiple disconnected apps to manage saving, insurance, and retirement.

Lack of Localization

Most platforms don’t address GCC-specific needs like shariah-compliant investments or local retirement options.

Complex Jargon

Financial terms and strategies are often presented in confusing language, making them hard to understand for beginners.

One-Size-Fits-All

Existing tools lack personalization, failing to adapt to different lifestyles, income levels, and financial goals.

Overall core issues

Overall core issues

1. Lack of Holistic Financial Awareness

Most users don’t have a clear understanding of their overall financial health. Existing tools only show fragments — spending, savings, or investments — without connecting them into a single, meaningful score or overview.

2. Fragmented Financial Management Experience

Managing money often requires switching between multiple platforms for different needs — saving, insurance, and retirement — leading to disjointed tracking and reduced motivation to maintain consistency.

3. Low Personal Relevance and Guidance

Financial insights and recommendations are typically generic. They don’t adapt to users’ goals, income patterns, or life stages, resulting in low engagement and lack of actionable direction.

4. Reactive Rather Than Proactive Planning

Users often act only when issues arise (e.g., running out of cash or missing savings goals), instead of being guided toward long-term financial stability through preventive, contextual nudges.

1. Lack of Holistic Financial Awareness

Most users don’t have a clear understanding of their overall financial health. Existing tools only show fragments — spending, savings, or investments — without connecting them into a single, meaningful score or overview.

2. Fragmented Financial Management Experience

Managing money often requires switching between multiple platforms for different needs — saving, insurance, and retirement — leading to disjointed tracking and reduced motivation to maintain consistency.

3. Low Personal Relevance and Guidance

Financial insights and recommendations are typically generic. They don’t adapt to users’ goals, income patterns, or life stages, resulting in low engagement and lack of actionable direction.

4. Reactive Rather Than Proactive Planning

Users often act only when issues arise (e.g., running out of cash or missing savings goals), instead of being guided toward long-term financial stability through preventive, contextual nudges.

App Vision & Value Proposition

App Vision & Value Proposition

The app is designed as an integrated personal finance platform that helps users understand, plan, and act on their financial goals through contextual and actionable insights.

Instead of simply tracking money, the app connects every aspect of a user’s financial life — from daily spending to long-term protection and retirement — into a cohesive journey that builds awareness and confidence.

Unlike traditional budgeting apps that focus on transactions, this app helps users connect the dots — transforming scattered financial data into meaningful insights, contextual guidance, and long-term clarity. It doesn’t just tell users where their money went — it shows where they’re heading, and how to get there safely.

The app is designed as an integrated personal finance platform that helps users understand, plan, and act on their financial goals through contextual and actionable insights.

Instead of simply tracking money, the app connects every aspect of a user’s financial life — from daily spending to long-term protection and retirement — into a cohesive journey that builds awareness and confidence.

Unlike traditional budgeting apps that focus on transactions, this app helps users connect the dots — transforming scattered financial data into meaningful insights, contextual guidance, and long-term clarity. It doesn’t just tell users where their money went — it shows where they’re heading, and how to get there safely.

02

02

Understanding the domain

Understanding the domain

Users segmentation

Users segmentation

We conducted research with GCC expats to uncover their biggest financial challenges—ranging from saving for the future, understanding shariah-compliant investments, to navigating local retirement options. These insights became the foundation for our design strategy.

We conducted research with GCC expats to uncover their biggest financial challenges—ranging from saving for the future, understanding shariah-compliant investments, to navigating local retirement options. These insights became the foundation for our design strategy.

Market Research & Competitor Analysis

Market Research & Competitor Analysis

Existing financial apps like Mint, Stash, or global robo-advisors provide broad solutions but lack localization. They often overlook GCC-specific needs such as cultural preferences, regional regulations, and shariah-compliant products. No platform offered a tailored, simplified experience for expats managing wealth in the region.

Existing financial apps like Mint, Stash, or global robo-advisors provide broad solutions but lack localization. They often overlook GCC-specific needs such as cultural preferences, regional regulations, and shariah-compliant products. No platform offered a tailored, simplified experience for expats managing wealth in the region.

Key Insights

Key Insights

Users need support in defining retirement targets early, making goal-setting a core feature of the platform.

Users need support in defining retirement targets early, making goal-setting a core feature of the platform.

Framing investment as the pathway to retirement highlights the need for simplified, beginner-friendly investment education.

Framing investment as the pathway to retirement highlights the need for simplified, beginner-friendly investment education.

Concise onboarding messages reduce intimidation, reinforcing the importance of clarity across the user journey.

Concise onboarding messages reduce intimidation, reinforcing the importance of clarity across the user journey.

Users need support in defining retirement targets early, making goal-setting a core feature of the platform.

Framing investment as the pathway to retirement highlights the need for simplified, beginner-friendly investment education.

Concise onboarding messages reduce intimidation, reinforcing the importance of clarity across the user journey.

03

03

Design Approach

Design Approach

Defining the Look & Feels

Defining the Look & Feels

We explored modern fintech platforms and regional cultural elements to shape WealthKarma’s visual identity. The goal was to create an approachable, trustworthy, and intuitive interface that balances professionalism with accessibility.

We explored modern fintech platforms and regional cultural elements to shape WealthKarma’s visual identity. The goal was to create an approachable, trustworthy, and intuitive interface that balances professionalism with accessibility.

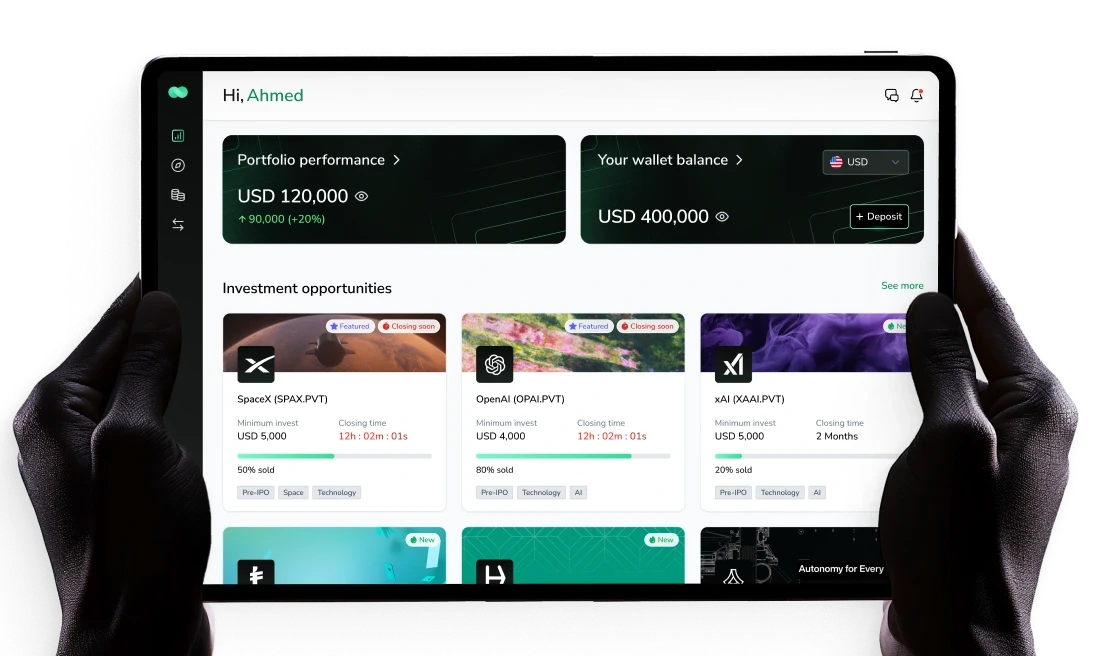

Build The MVP Platform

Build The MVP Platform

We translated user insights and design directions into an interactive prototype. Core features such as setting up a retirement fund, tracking financial progress, and conducting quick financial health checks were prioritized to provide immediate value and clarity for users.

We translated user insights and design directions into an interactive prototype. Core features such as setting up a retirement fund, tracking financial progress, and conducting quick financial health checks were prioritized to provide immediate value and clarity for users.

Iteration & Refinement

Iteration & Refinement

Through user testing, we refined the flow, simplified complex terms, and enhanced personalization. This iterative process ensured that WealthKarma feels practical for beginners while remaining powerful for experienced planners.

Through user testing, we refined the flow, simplified complex terms, and enhanced personalization. This iterative process ensured that WealthKarma feels practical for beginners while remaining powerful for experienced planners.

01

01

Financial Scoring

Financial Scoring

Get personalized supplement recommendations, tailored to your lifestyle and health goals—all guided by AI insights.

Get personalized supplement recommendations, tailored to your lifestyle and health goals—all guided by AI insights.

01

Financial Scoring

Get personalized supplement recommendations, tailored to your lifestyle and health goals—all guided by AI insights.

02

02

Emergency Fund

Emergency Fund

Build up to 6 months of expenses to stay financially secure in case of unexpected events. Track progress and contribute with ease.

Build up to 6 months of expenses to stay financially secure in case of unexpected events. Track progress and contribute with ease.

02

Emergency Fund

Build up to 6 months of expenses to stay financially secure in case of unexpected events. Track progress and contribute with ease.

03

03

Secure Policies

Secure Policies

Store and track all your insurance policies in one place. Upload documents, set expiry reminders, and stay protected with ease.

Store and track all your insurance policies in one place. Upload documents, set expiry reminders, and stay protected with ease.

03

Secure Policies

Store and track all your insurance policies in one place. Upload documents, set expiry reminders, and stay protected with ease.

04

04

Retirement Tracker

Retirement Tracker

Plan, track, and grow your retirement fund with personalized insights. Adjust expenses, set goals, and explore investment scenarios with confidence.

Plan, track, and grow your retirement fund with personalized insights. Adjust expenses, set goals, and explore investment scenarios with confidence.

04

Retirement Tracker

Plan, track, and grow your retirement fund with personalized insights. Adjust expenses, set goals, and explore investment scenarios with confidence.

05

05

Financial Insights

Financial Insights

Discover lessons, articles, and masterclasses tailored for GCC expats to manage savings, investments, and retirement with ease and confidence.

Discover lessons, articles, and masterclasses tailored for GCC expats to manage savings, investments, and retirement with ease and confidence.

05

Financial Insights

Discover lessons, articles, and masterclasses tailored for GCC expats to manage savings, investments, and retirement with ease and confidence.

Impact

The design helped turn the initial idea into a functional MVP and later into a market-ready product. It allowed the team to validate core features early, refine them based on user feedback, and ensure the final experience met both business and user needs.

Retirement Readiness

More users setting up retirement funds.

Ease of Use

Users find financial planning easier.

Financial Engagement

More users track savings and investments.

Trust in Guidance

Higher confidence in recommendations.

What our client says?

I was impressed with their commitment and professionalism.

Tigo Design was productive and committed to the project, allowing them to meet expectations. The team had great communication skills and was receptive to new ideas. They had great project management skills; they were responsive to the client and professional, resulting in a seamless engagement.

Gasser Salem

CEO of Wealth Karma

Verified by

I was impressed with their commitment and professionalism.

Tigo Design was productive and committed to the project, allowing them to meet expectations. The team had great communication skills and was receptive to new ideas. They had great project management skills; they were responsive to the client and professional, resulting in a seamless engagement.

Gasser Salem

CEO of Wealth Karma

I was impressed with their commitment and professionalism.

Tigo Design was productive and committed to the project, allowing them to meet expectations. The team had great communication skills and was receptive to new ideas. They had great project management skills; they were responsive to the client and professional, resulting in a seamless engagement.

Gasser Salem

CEO of Wealth Karma

Verified by